On Friday morning, the Democrat Party’s Build Back Better Act was passed in the House. The implication of this act tilts towards the fact that high-income earners in numerous American states will see a heavy slash on their taxes.

This particular provision of the act takes priority over other terms of the new law. At the moment, word has it this was fixed into the legislation by a high-profile Democrat Party member.

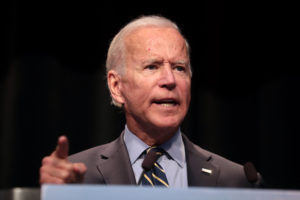

According to the nonpartisan Committee for a Responsible Federal Budget, increasing the SALT cap to $80,000 through 2025 would cost the federal government a jaw-breaking $275 billion in revenue. Is this really a prudent move by the Biden-led government?

What Statistics State About the Build Back Better Act

The Joint Committee on Taxation estimated just recently the change in the SALT cap due to the new act would cost the nation about $230 billion within five years. However, the huge spending is expected to generate no less than $14 billion after the cap has been returned to $10,000 in 2027.

In a further analysis the House conducted, the major reason for the tax cut for the rich is the numerous other tax hikes targeted at the wealthy in society. According to JCT’s analysis, millionaires in America would get a tax cut in the first year of the act’s implementation.

Those who didn’t get a tax cut in that first year would in the last year before the cap is eventually reduced.

Curious about what's in the Build Back Better Bill the House just passed?

Thank you @lpackard for continuing to raise awareness around health care issues.

Check out the full conversation: https://t.co/Dfn0npVi96@MuellerSheWrote @mswmediapods pic.twitter.com/7yUWHeEeEW— The Daily Beans Podcast (@dailybeanspod) November 21, 2021

The SALT cap appears to be the most expensive item when providing analysis of the act within a five-year time frame; however, there are other provisions in the act that are more expensive within the budget window of a year.

An example given by the JCT is the child tax credit, which would incur about $100 billion from the nation’s treasury for a year. However, the cost of running it for five years would be less than the SALT cap increase.

What Economic Experts Have to Say About this New Act

Numerous economic analysts have weighed in on the Build Back Better Act. A major point of concession for them is the increase of the SALT cap raises taxes on paper.

The reason for this is the current $10,000 SALT cap is expected to expire in 2026; however, the current administration of Joe Biden intends to make it permanent from 2027. What this means is the federal government would raise revenues from the year 2027 to the year 2031.

Here's a look at a few of the many reasons why Build Back Better is an extremely flawed bill. It also adds almost $400 billion to the deficit after we were told it would cost $0. Hard pass. pic.twitter.com/qoDWGOgQXO

— Rep. Nancy Mace (@RepNancyMace) November 21, 2021

Kyle Pomerleau, a senior fellow at the American Enterprise Institute, opined in the analysis of the act that within a ten-year time frame, the SALT deduction doesn’t lose revenue.

As a matter of fact, despite the tax cut from the first five years, it ends up raising more revenue for the treasury in the last five years.