Democrats in the House have presented proposals that might put a stop to Trump’s corporate and affluent tax cuts. If enacted, this might lead to the largest tax rises in decades.

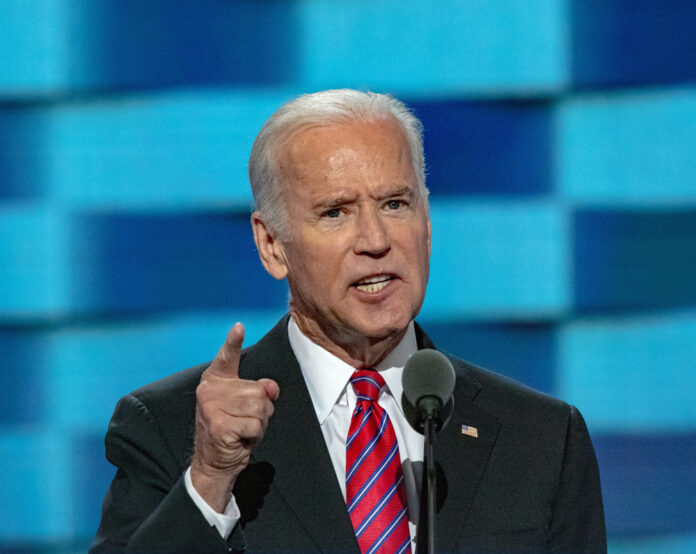

Biden to Undo Trump’s Tax Cuts?

Despite the fact that these tax reforms are intended to fulfill President Joe Biden’s pledges to combat unfairness, they are scaled down in an attempt to attract moderate Democrats.

The new plan recommends increasing the maximum tax rate on capital gains from 20% to 25%, as opposed to virtually tripling it to 39.6% as Biden had originally advocated.

And the corporation tax rate would only increase to 26.5 percent from 28 percent.

How Hard Will This Hit Your Bank Account?

Let’s analyze how these tax hikes may impact you.

Originally, President Biden presented a variety of tax suggestions, including an increase from 20% to 39.6% in the highest capital gains tax rate. With the 3.8% Medicare surtax on high earners, the maximum rate would increase to 43.4%. Under his initial draft, both short and long-term capital gains would’ve been subject to the same rate of 39.6% in the highest income tax band.

Additionally, Biden recommended closing a tax loophole that exempts capital gains included in an estate from taxation. The President stated that the IRS should examine top incomes more thoroughly to ensure that they are contributing their due share of taxes. Additionally, tax hikes are intended to help pay increased IRS oversight.

Biden's plans to raise taxes on corporations and the wealthy are losing momentum. Of course. https://t.co/mEPuHC3T3n

— Barbara Malmet (@B52Malmet) July 8, 2021

What’s the New Plan?

The Democrats in the House of Representatives have just unveiled a revised list of the tax reform plan that Vice President Biden presented in April. Although there are recurring themes, a few of the amounts have been reduced.

This action is presumably a result of the Democrats’ desire to avoid alienating voters prior to the midterm elections in 2022. There are additionally political constraints on the implementation of such drastic changes. However, it is also possible that Biden aimed big, knowing that Congress would attempt to limit his ideas.

Higher Corporate Tax Rates to the Stratosphere

The proposed change consists of various components. It would increase the tax rate on corporations from 21% to 26.5% for enterprises with above $5 million in taxable income. This would increase the highest income tax level from 37% to 39.6% for individuals and families earning more than $450,000 and $400,000 yearly, respectively.

The maximum capital gains tax rate would increase from 20% to 25%. A 3% extra surtax on annual incomes over $5 million is also currently in the pipeline. The Democrats would also like to have a $80 billion spending increase for the IRS during the next ten years. This type of program has the possibility of recovering hundreds of billions of dollars in wasted tax income throughout the same time frame.

Biden's plans to raise taxes on corporations and the wealthy are losing momentum. Of course. https://t.co/mEPuHC3T3n

— Barbara Malmet (@B52Malmet) July 8, 2021

A significant characteristic of both the initial and revised tax plans is that they are intended to affect primarily the highest earners. Consequently, most individuals will not be impacted by any adjustments.