The US military is practically financing indirectly its biggest enemy, the armed forces of Communist China.

The reason is that US service personnel’s Thrift Savings Plan is allowed to invest in Chinese companies.

The warning comes in a new report.

US Citizens Investing in Chinese Companies Is ‘Unconscionable’

The report by Newsweek, whose title proclaims that the US military “is funding China’s military,” points out there is hardly anything “more hideous” than a case, in which a military is “paying” for its enemy’s weapons.

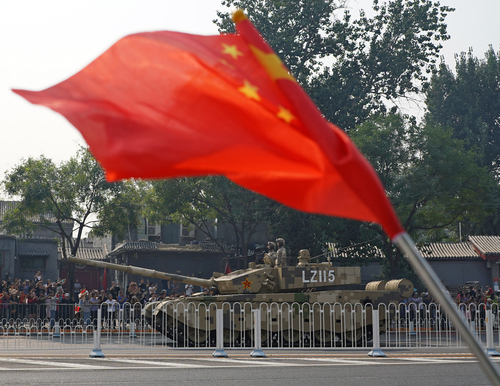

Money invested by US service personnel is “inadvertently” funding Communist China’s development of “tanks, ships, and planes” designed to kill them, writes commentator Gordon G. Chang.

Change notes that US service members have been allowed since 2001 to take part in the federal government’s Thrift Savings Plans (TSP), an investment and retirement program similar to a 401(k).

TSP investors can put their money in companies based in the People’s Republic of China, which include a total of 22 “China-only” mutual funds.

Chang stresses that companies in China tend to be “un-investable” since investors are put in a position in which they have no way of knowing what risks they assume, and don’t get rewarded for taking those risks.

He notes further that what makes matters worse is the fact that Chinese companies like to “mislead investors,” while the government of the Chinese Communist Party prevents US regulators from getting the audit papers of those China-based firms listed in the US because those may contain “state secrets.”

Trusting Chinese Stocks? Not So Fast…

Because of that, the author emphasizes, Chinese companies frequently “trade on rumor,” which makes them very volatile.

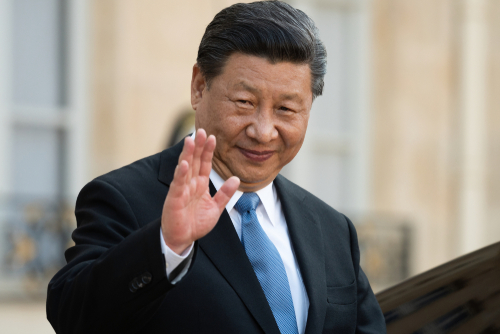

He points out recent wide fluctuations in China’s stocks connected with the 20th congress of the Chinese Communist Party, which cemented President Xi Jinping’s dictatorship, or with the Communists’ whims on their “zero-COVID” policy, which has led to monstrous lockdowns of industrial hubs.

Against that backdrop, there are about 35 Chinese companies in the TSP’s International Fund, which is “unconscionable,” according to the former chief of US-Chinese Economic and Security Review Commission, Roger Robinson.

Robinson added that hundreds of other Chinese companies are “littering the Mutual Fund Window,” set up by Federal Retirement Thrift Investment Board. These include even corporate bad actors sanctioned by the US government.

Absolutely hideous: Members of #America’s military are funding the development of weapons that #China intends to use to kill them: https://t.co/CjE13hK3Gp. @josh_hammer @NewsweekOpinion

— Gordon G. Chang (@GordonGChang) November 14, 2022

Everyone should check their portfolios and make sure you’re not funding the ccp prc china’s military human captivity or organ harvesting.

To say the least.— Ceres -🦍- Cosmic Chirp (@CosmicChirp) November 9, 2022

Important:

Xi Jinping just requested the Chinese military “devote all its energy” toward preparing for war.

Shared from the Epoch Times. pic.twitter.com/xGSkuY3Z8V

— Chase 🇺🇸🏛⚡️ (@sovereignbrah) November 11, 2022

Xi Has Fused Together Military and Civilian Affairs

Chang recalls that in November 2020, then-US President Donald Trump issued an executive order banning American citizens from investing in a total of 31 companies linked to the People’s Liberation Army, as the military of Communist China is officially known.

The author stressed, though, that investing in non-military Chinese firms is also just as “objectionable” simply because the dictatorship of Xi Jinping has “fused” civilian and military affairs, making all kinds of private and civilian companies at the disposal of the Communist Party and its military.

Among other measures, the Xi regime has started enforce “vigorously” an old rule requiring that every single firm with at least three members of the Chinese Communist Party should have its own party cell.

The Chinese Communist Party, which controls the military, also control practically all military and non-military companies in the country.

So much so, that BlazeTV host Kevin Freeman has compared investing in Commie China to being so “foolish” as to invest in Nazi Germany towards the end of the 1930s.

Even though in May 2020, the Trump Administration told the Federal Retirement Thrift Investment Board, the principal of TSP, that Chinese stocks are off limits, it still decided that Hong Kong-based companies are good for investing.

While Hong Kong is a special administrative district of China, though, it is also fully controlled by the Communist regime.

A bill introduced by Republican US Senator Tommy Tuberville of Alabama last year, which bans TSP in China, is still expecting to be adopted by the US Congress.

"Members of America's armed services have, since 2001, been allowed to participate in the Thrift Savings Plan (TSP), a federal government-sponsored long-term retirement and investment program that is akin to a 401(k). "

— Matt Reynolds (@MattReyxx) November 15, 2022